Introduction to Cash Envelope Budgeting

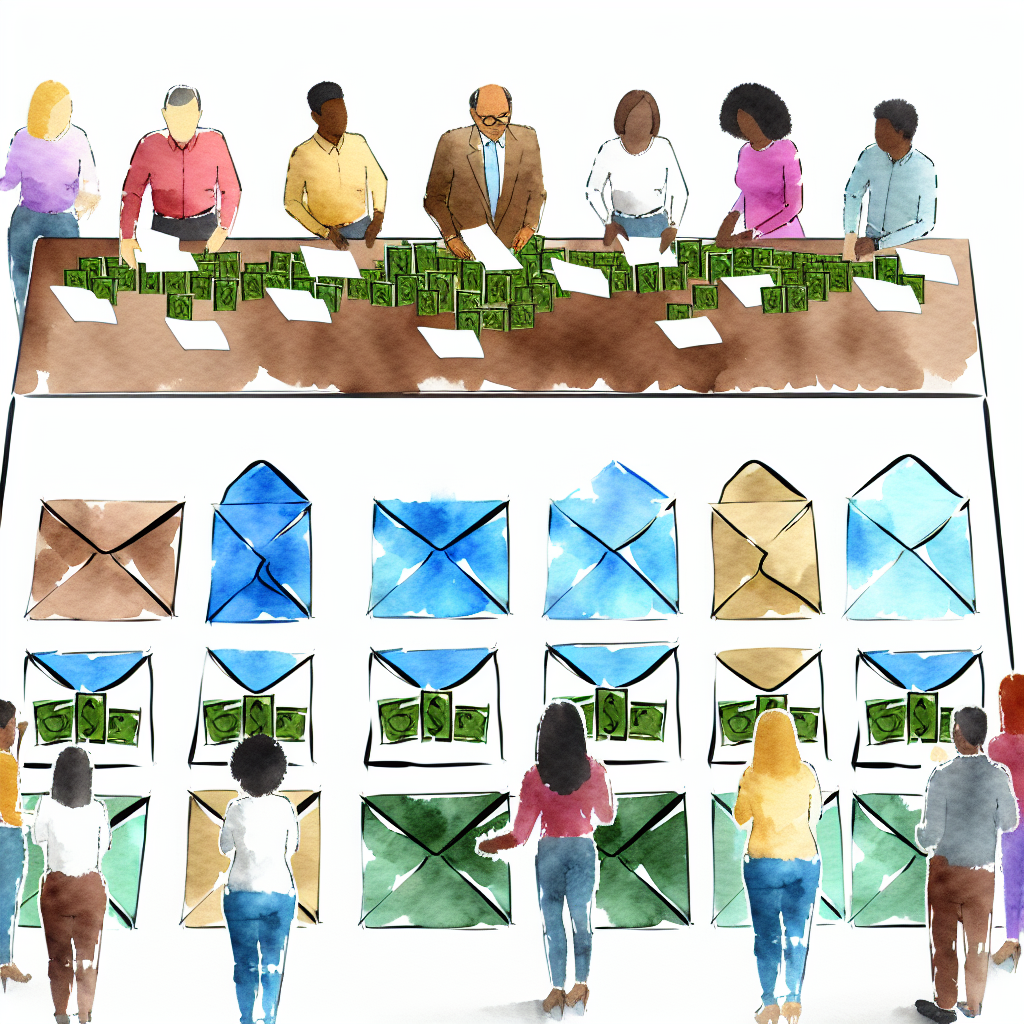

Managing personal finances can often feel like an overwhelming task, filled with endless spreadsheets, digital apps, and a constant juggling act between income and expenses. In an age where technology dominates every aspect of our lives, budgeting tools are mostly digital. However, an old-school method is making a remarkable comeback: cash envelope budgeting. This strategy involves using physical envelopes to allocate cash for various spending categories, promoting disciplined spending and intentional financial planning.

The origin of cash envelope budgeting dates back to a time when digital transactions were nonexistent. This method gained popularity in the mid-20th century as a way for individuals and families to manage their finances tangibly. Despite the advent of digital technology, the tactile nature of handling cash has proven to be an effective tool for those looking to harness better control over their spending.

The essence of cash envelope budgeting lies in its straightforwardness. You allocate a specific amount of cash to envelopes categorized by your spending needs, such as groceries, entertainment, and transportation. Once the money in an envelope is spent, you cannot spend any more in that category until the next budgeting cycle. This system is designed to prevent overspending and helps people become more aware of their financial habits.

Many financial experts and personal finance advocates champion cash envelope budgeting for its simplicity and effectiveness. Despite being an “old-fashioned” method, its principles remain highly relevant today. In this article, we will explore the benefits of using cash envelopes for effective budgeting, provide a step-by-step guide to setting up your system, and compare it to modern digital budgeting tools.

How Cash Envelopes Encourage Better Spending Habits

One of the main reasons people struggle with budgeting is the abstract nature of digital money. Swiping a card or tapping an app makes it easy to disassociate from the physical act of spending. Cash envelopes, on the other hand, put your money front and center, making each transaction more tactile and real. This physical interaction forces you to think twice before making a purchase, thereby promoting better spending habits.

When you use cash envelopes, you’re more likely to adhere to your budget because you can physically see how much money you have left for each category. This form of budgeting eliminates the guesswork associated with multiple bank balances and pending transactions. Knowing exactly how much you have—and seeing it decrease with each purchase—can be a wake-up call that fosters more mindful spending.

A study by the Journal of Consumer Research found that people who use cash are generally more deliberate in their purchasing decisions. The physical constraints of cash make you question the necessity and value of each purchase, enhancing your overall financial discipline. Unlike credit cards, which can tempt you to overspend due to the credit limit, cash envelopes limit your spending to the actual money you have.

Another significant advantage is the elimination of surprise expenses. By allocating specific amounts to different categories upfront, you are less likely to encounter unexpected costs. Even when unforeseen expenses do arise, the envelope system encourages you to make adjustments within the allocated funds rather than resorting to unplanned debt or credit card use.

Step-by-Step Guide to Setting Up a Cash Envelope System

Setting up a cash envelope system may seem daunting at first, but it’s a straightforward process that can yield significant financial benefits. Here is a step-by-step guide to get you started:

-

Determine Your Budget: The first step is to evaluate your total monthly income and identify your spending categories. Common categories include groceries, utilities, entertainment, transportation, dining out, and savings. Write down each category and allocate a specific amount of money for the month.

-

Create Your Envelopes: Once you have determined your spending categories and their respective budgets, label each envelope with the category name. Divide your cash into the envelopes according to the amounts you’ve allocated. For instance, if your grocery budget is $300, put $300 in the grocery envelope.

-

Track Your Spending: As you spend from each envelope, make a note of the expenditures. You can write directly on the envelope or maintain a separate log. This helps you stay accountable and monitor where your money is going.

-

Adjust as Needed: At the end of the month, evaluate how well the envelope system worked for you. Were certain categories overspent while others had leftover cash? Use this information to adjust your allocations for the next month. Flexibility is key to maintaining a practical and sustainable budgeting system.

Here’s a simple example of how you might structure your cash envelopes:

| Category | Budgeted Amount |

|---|---|

| Groceries | $300 |

| Utilities | $150 |

| Entertainment | $100 |

| Transportation | $100 |

| Dining Out | $75 |

| Savings | $200 |

| Emergency Fund | $75 |

By sticking to your cash envelope allocations, you’ll likely find yourself spending money more consciously and efficiently. The goal is not perfection but progress in managing your finances better.

Choosing the Right Categories for Your Cash Envelopes

Choosing the right categories for your cash envelopes is crucial to the system’s success. Each person’s spending habits and financial obligations are unique, so your categories should reflect your specific lifestyle and priorities. Here are some tips for selecting the right categories:

-

Essential Categories: These are categories that cover your basic needs such as food, shelter, transportation, and utilities. These should be your top priority, ensuring you have enough funds allocated to these areas each month.

-

Variable Expenses: Include categories that may fluctuate month to month, such as entertainment, dining out, and miscellaneous expenses. These are often areas where people tend to overspend, so keeping a stringent eye on them can help curtail unnecessary expenditures.

-

Savings and Investments: Don’t forget to include envelopes for savings and future investments. An emergency fund, retirement savings, and short-term goals like vacations should have dedicated envelopes. Prioritizing savings helps build a financial cushion against unexpected expenses or opportunities that require immediate funds.

To make things a bit easier, you can start with a template and tweak it according to your needs:

| Category | Estimated Monthly Amount |

|---|---|

| Rent/Mortgage | $1000 |

| Groceries | $300 |

| Utilities | $200 |

| Transportation | $150 |

| Insurance | $100 |

| Entertainment | $100 |

| Dining Out | $75 |

| Health/Medical | $50 |

| Savings | $200 |

| Emergency Fund | $50 |

| Miscellaneous | $50 |

Your goal should be a balanced budget that allows flexibility without compromising essential needs. As you get more comfortable with the system, you can add or remove categories based on your financial behavior and goals.

The Psychological Benefits of Using Cash for Transactions

Using cash for transactions carries several psychological benefits that can profoundly impact your financial well-being. One of the most significant advantages is the reduced likelihood of overspending. Handling physical cash makes you more aware of your spending, unlike digital transactions, which can feel abstract and disconnected from real money.

Studies have shown that people experience more “pain” when parting with cash compared to swiping a card. This psychological barrier can act as a natural deterrent against impulsive purchases. The tangible nature of cash forces you to think twice before making a purchase, questioning its necessity and impact on your budget.

Another psychological benefit is improved self-discipline. By using cash envelopes, you create a physical constraint that limits your spending to the amount allocated in each envelope. This limitation can help build better financial habits over time, making you more mindful and deliberate in your spending choices.

Furthermore, cash transactions contribute to a greater sense of accomplishment. Every time you stick to your budget and manage your envelopes efficiently, it reinforces positive financial behaviors, boosting your confidence and motivation to continue. This positive reinforcement can be especially beneficial for individuals struggling with debt or trying to save for long-term goals.

Overall, the psychological benefits of using cash envelopes extend beyond immediate financial gains. They foster a sense of control, discipline, and satisfaction, making it easier to stick to your budgeting plan and achieve your financial objectives.

Maintaining Accountability and Tracking Progress

Accountability is a crucial component of successful budgeting, and the cash envelope system naturally promotes it. By using physical cash, you create a built-in mechanism to hold yourself accountable for your spending decisions. Here are some tips to maintain accountability and track your progress effectively:

-

Regular Check-ins: Set aside time each week to review your envelopes and track your spending. This helps you stay on top of your budget and make necessary adjustments if you are overspending in any category. Regular check-ins also allow you to celebrate small victories, such as staying within budget for a particular category.

-

Expense Tracking: Use a notebook, spreadsheet, or budgeting app to record your expenses. While the cash envelope system is physical, digital tools can complement it by providing a detailed overview of your spending patterns. Tracking your expenses helps you identify areas where you can cut back and allocate funds more efficiently.

-

Accountability Partners: Share your budgeting goals with a trusted friend, family member, or partner. Having someone to hold you accountable can provide additional motivation to stick to your budget. You can also set up regular check-ins with your accountability partner to review your progress and discuss any challenges you face.

Here’s a simple table to help you track your expenses:

| Date | Category | Amount Spent | Remaining Balance |

|---|---|---|---|

| 01/05/2023 | Groceries | $50 | $250 |

| 01/07/2023 | Transportation | $30 | $120 |

| 01/10/2023 | Entertainment | $20 | $80 |

| 01/12/2023 | Dining Out | $15 | $60 |

By maintaining accountability and tracking your progress, you can ensure that the cash envelope system works effectively for you. It helps build better financial habits, encourages mindful spending, and keeps you on track to achieve your financial goals.

How to Adjust Your Cash Envelope System Over Time

The cash envelope system is not a one-size-fits-all solution, and it may require adjustments as your financial situation changes. Here are some tips to help you adapt your cash envelope system over time:

-

Evaluate Your Budget Regularly: Review your budget at the end of each month to assess how well you adhered to your envelope allocations. Identify any categories where you consistently overspend or have leftover cash. Adjust your budget for the next month based on these insights to better align with your spending habits.

-

Adjust Categories as Needed: As your financial goals and priorities change, you may need to add or remove categories from your envelopes. For example, if you start a new hobby or activity, create a new envelope dedicated to it. Conversely, if you pay off a debt, you can reallocate those funds to other categories or savings.

-

Incorporate Seasonal and Irregular Expenses: Some expenses are seasonal or irregular, such as holiday gifts, car maintenance, or annual subscriptions. Plan for these expenses by creating additional envelopes and contributing to them throughout the year. This ensures you have funds available when these expenses arise without disrupting your regular budget.

Here’s an example of how you might adjust your envelope categories over time:

| Month | New Category | Amount | Reason for Change |

|---|---|---|---|

| February | Gym Membership | $30 | Started a new fitness routine |

| March | Vacation Fund | $50 | Saving for a summer vacation |

| April | Medical Expenses | $40 | Anticipating medical check-ups |

| May | Debt Repayment | -$50 | Paid off a credit card debt |

By regularly evaluating your budget and making necessary adjustments, you can ensure that your cash envelope system remains effective and aligned with your financial goals. Flexibility is key to maintaining a sustainable budgeting system that adapts to your changing needs.

Common Mistakes to Avoid with Cash Envelopes

While the cash envelope system is a powerful budgeting tool, it’s essential to avoid common mistakes that can undermine its effectiveness. Here are some pitfalls to watch out for:

-

Not Sticking to the Budget: One of the fundamental principles of the cash envelope system is to spend only the cash allocated in each envelope. Avoid the temptation to dip into other envelopes or withdraw additional funds when you run out. Doing so can disrupt your entire budget and defeat the purpose of the system.

-

Ignoring Irregular Expenses: Failing to account for irregular or unexpected expenses can throw your budget off balance. Plan for these expenses by creating envelopes for irregular costs or maintaining a buffer in your budget. This ensures you are prepared without compromising your regular spending.

-

Lack of Consistency: Consistency is crucial for the success of the cash envelope system. Make it a habit to use your envelopes for every transaction, and regularly track your spending. Inconsistency can lead to financial disorganization and make it challenging to stay on budget.

-

Neglecting Savings: Prioritizing spending categories without including savings can hinder your long-term financial goals. Ensure you allocate funds to savings envelopes, such as an emergency fund, retirement, and specific short-term goals. Savings should be an integral part of your budgeting strategy.

-

Overcomplicating the System: While it’s essential to tailor the envelope system to your needs, overcomplicating it with too many categories can be counterproductive. Stick to a manageable number of categories that cover your most significant expenses, and make adjustments as needed.

By avoiding these common mistakes, you can maximize the effectiveness of the cash envelope system and achieve better financial management. The goal is to create a practical and sustainable budgeting system that helps you stay on track and achieve your financial objectives.

Comparing Cash Envelope Budgeting to Digital Budgeting Tools

While cash envelope budgeting offers several tangible benefits, it’s essential to understand how it compares to digital budgeting tools. Both methods have their advantages and can complement each other to create a comprehensive budgeting strategy.

Cash Envelope Budgeting: Pros and Cons

Pros:

- Tactile Experience: Handling physical cash makes spending feel more real and immediate, promoting better spending habits.

- Visible Limits: Cash envelopes provide a clear visual indication of how much money is left in each category, reducing the likelihood of overspending.

- Simplicity: The system is straightforward and easy to set up, making it accessible to individuals of all financial literacy levels.

Cons:

- Inconvenience: Carrying cash and envelopes can be cumbersome and less convenient than using digital payment methods.

- Security Risks: Physical cash is susceptible to loss or theft, posing a security risk.

- Limited Tracking: While cash envelopes provide a tangible way to manage spending, they lack the detailed tracking and analytical features of digital tools.

Digital Budgeting Tools: Pros and Cons

Pros:

- Convenience: Digital tools offer the convenience of tracking and managing finances on the go, with access through smartphones and computers.

- Security: Digital transactions are generally more secure and less susceptible to physical loss or theft.

- Detailed Analysis: Digital tools provide detailed tracking, analytics, and reports, helping users gain deeper insights into their spending patterns.

Cons:

- Detachment from Spending: Digital transactions can feel abstract, making it easier to overspend without realizing it.

- Complexity: Some digital tools may have a learning curve and require technical proficiency to use effectively.

- Subscription Costs: Many digital budgeting tools come with subscription fees, adding to the cost of managing personal finances.

Ultimately, the choice between cash envelope budgeting and digital tools depends on individual preferences and financial goals. Some people may find a combination of both methods works best, leveraging the tactile experience of cash envelopes for day-to-day expenses and the analytical power of digital tools for long-term planning.

Success Stories: Real-Life Examples of Cash Envelope Users

Hearing real-life success stories can be inspiring and motivating for those considering the cash envelope system. Here are a few examples of individuals who have successfully used cash envelopes to transform their financial lives:

Sarah’s Debt-Free Journey

Sarah, a single mother of two, struggled with credit card debt and found it challenging to make ends meet each month. She decided to try the cash envelope system to gain better control over her finances. By allocating specific amounts to each spending category, Sarah was able to track her expenses more effectively and avoid unnecessary purchases. Within a year, she paid off her credit card debt and built an emergency fund, giving her peace of mind and financial stability.

John’s Savings Success

John, a recent college graduate, wanted to save for a down payment on a house. He adopted the cash envelope system to manage his expenses and prioritize saving. By creating envelopes for essential categories and dedicating a significant portion of his budget to a savings envelope, John was able to save consistently each month. After two years of disciplined budgeting, he achieved his goal and purchased his first home.

Lisa’s Financial Independence

Lisa, a freelancer with variable income, found it challenging to stick to a budget due to irregular earnings. She implemented the cash envelope system to regain control over her finances. By allocating funds to envelopes based on her average monthly income and adjusting her budget as needed, Lisa was able to manage her expenses more efficiently. The envelope system helped her build a financial cushion, providing stability and confidence in her financial future.

These success stories demonstrate the power of the cash envelope system in helping individuals achieve their financial goals. The simplicity and tangible nature of the system make it accessible and effective for people from various financial backgrounds.

Conclusion: Is Cash Envelope Budgeting Right for You?

Cash envelope budgeting is a time-tested method that offers numerous benefits, from promoting better spending habits to providing psychological advantages. While it may require an initial adjustment period, the system’s simplicity and effectiveness make it a valuable tool for anyone looking to improve their financial management.

One of the most significant advantages of cash envelope budgeting is its ability to make spending feel more tangible and real. The physical act of handling cash can create a stronger sense of financial responsibility, leading to more deliberate and mindful spending. This tactile experience is something digital transactions often lack, making the cash envelope system a powerful tool for those prone to overspending.

However, it’s essential to consider your personal preferences and financial goals when deciding if the cash envelope system is right for you. If you value the convenience and security of digital transactions, you may find it beneficial to supplement the cash envelope system with digital budgeting tools. This combination can provide a comprehensive approach to managing your finances, offering both the tactile benefits of cash and the analytical power of digital tools.

Ultimately, the key to successful budgeting lies in finding a system that works for you and staying consistent with it. Whether you choose the cash envelope method, digital tools, or a combination of both, the goal is to create a sustainable budgeting strategy that helps you achieve your financial objectives.

Recap

In this article, we explored the benefits of using cash envelopes for effective budgeting. Here’s a recap of the main points:

- Introduction to Cash Envelope Budgeting: A method that involves using physical envelopes to allocate cash for various spending categories.

- How Cash Envelopes Encourage Better Spending Habits: The tactile nature of cash promotes more deliberate and mindful spending.

- Step-by-Step Guide to Setting Up a Cash Envelope System: A straightforward process to allocate cash to different spending categories.

- Choosing the Right Categories for Your Cash Envelopes: Tips for selecting categories that reflect your specific lifestyle and financial priorities.

- The Psychological Benefits of Using Cash for Transactions: Using cash can reduce overspending, improve self-discipline, and provide a

Deixe um comentário