How Living Debt-Free Unlocks Personal Liberation in Modern Life

Introduction to Living Debt-Free: Understanding the Concept

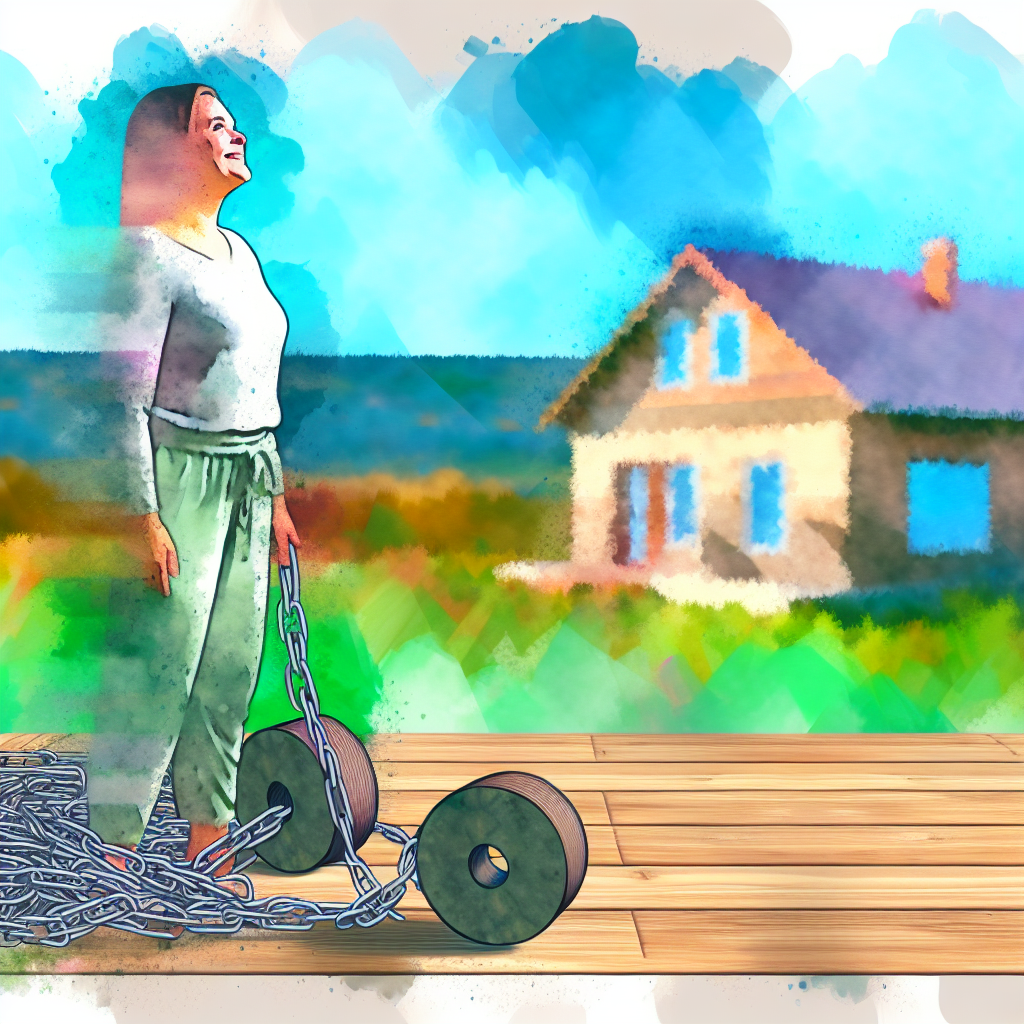

In today’s fast-paced world, financial obligations often weigh heavily on individuals, tethering them to a cycle of earnings and expenses that seem never-ending. The concept of living debt-free offers a path out of this cycle, promising a life unshackled by financial burdens. At its core, being debt-free means having no outstanding obligations to creditors. This lifestyle is characterized by financial choices that avoid the accumulation of debts, enabling an individual to live within their means and prioritize saving and investing over borrowing.

Living free of debt is more than just a financial status; it represents a significant lifestyle shift. A debt-free life calls for a complete overhaul of one’s spending and saving strategies, underpinned by a commitment to resisting the lure of consumerism and instant gratification. This approach can initially seem daunting, especially in an economy believing in the power of credit to fuel personal advancement. However, the rewards of pursuing this path often extend beyond financial stability, impacting various other aspects of life positively.

The movement towards a debt-free lifestyle is gaining momentum as more individuals recognize its potential to offer personal liberation. This liberation manifests itself as a newfound sense of control over one’s financial destiny and life choices, reducing the anxieties associated with living paycheck to paycheck or under the thumb of creditors. As such, living debt-free has become a beacon of hope for many striving for true financial freedom and independence.

The Psychological Burden of Debt: Why It Holds You Back

Debt often casts a long shadow that extends beyond the confines of financial statements, affecting personal well-being and psychological health. The stress of dealing with debt can be overwhelming, leading individuals to feel trapped in a cycle of obligations that are difficult to break. This stress is compounded when debts are large or involve multiple creditors, creating a sense of being overwhelmed and a lack of control over one’s financial future.

Psychologically, debt is more than just a financial nuisance; it can significantly impact self-esteem and personal relationships. Often, individuals in debt experience shame and guilt, stigmatizing their financial behaviors as personal failures. This perception can lead to a negative self-image and increased anxiety levels, hindering individuals from taking the proactive steps necessary to escape debt.

Moreover, the psychological burden of debt often manifests in physical symptoms such as fatigue, headaches, and depression. These health issues further exacerbate the problem, creating a vicious cycle that is difficult to escape. Understanding the psychological burden of debt is crucial, as it highlights the importance of addressing not only the financial aspects of debt but also its psychological effects, pointing to the broader benefits of living debt-free.

Financial Freedom: How Debt-Free Living Brings Economic Independence

Embarking on the journey towards living debt-free brings with it a host of benefits, not the least of which is financial freedom. This freedom is characterized by an autonomous control over financial resources, devoid of any strings attached to creditors. The absence of debt means that individuals can fully allocate their income towards personal goals such as saving, investing, or even indulging in leisure activities, without the looming fear of debt repayment obligations.

Economic independence achieved through debt-free living lays the foundation for a stable financial future. By eliminating debts, individuals can focus on building their wealth through investments, effectively multiplying their financial resources. This shift from debt repayment to accumulation provides a sense of security, as savings can serve as a buffer against unexpected expenses and safeguard one’s financial wellbeing during challenging times.

Moreover, financial freedom is synonymous with the ability to make life choices unfettered by monetary concerns. Whether it’s pursuing a passion, changing careers, or even traveling the world, the possibilities are endless when financial constraints no longer dictate one’s life choices. Trading the burden of debt for the flexibility that comes with financial freedom is a transformative experience, highlighting the profound impact of a debt-free lifestyle on personal liberation and economic independence.

Mental Health Benefits of Being Debt-Free: Stress Reduction and Peace of Mind

A significant advantage of being debt-free is the positive impact it has on mental health. Debt is often accompanied by stress and anxiety, which can permeate all aspects of life. Once the burden of debt is lifted, many individuals report a near-immediate reduction in stress and an overall improvement in their quality of life. This stress relief comes from knowing that one’s financial obligations are manageable and within one’s control.

The peace of mind associated with debt-free living cannot be overstated. Without the constant worry about making ends meet or dealing with debt collectors, individuals can enjoy a more relaxed and less pressured lifestyle. This peace translates into better sleep, improved focus, and ultimately a greater sense of happiness and well-being. The reduction in stress related to financial matters allows individuals to direct their energy and attention to more fulfilling activities and relationships.

Additionally, the mental health benefits of being debt-free extend into self-esteem and personal confidence. Knowing that one’s financial house is in order instills a sense of accomplishment and control. This newfound confidence can lead to more assertive decision-making in all areas of life, further enhancing personal growth and satisfaction. The connection between financial stability and mental health underscores the far-reaching benefits of embracing a debt-free lifestyle.

Creating a Debt-Free Lifestyle: Key Steps to Take

Building a debt-free lifestyle begins with a conscious decision to change one’s approach to personal finance. The journey requires dedication, but with strategic planning and persistence, it is an achievable goal. Here are some key steps to guide you towards debt-free living:

-

Assessment and Planning: Begin by thoroughly assessing your current financial position. List all debts and analyze your income and expenses to identify areas where you can cut back. Next, develop a clear financial plan that includes realistic goals for repaying debts and timelines.

-

Budgeting: Establish a comprehensive budget that prioritizes debt repayment. This involves distinguishing between needs and wants, ensuring that your spending aligns with your goal of eliminating debt. Regularly review and adjust your budget to reflect changes in income or expenses.

-

Debt Repayment Strategies: Consider using debt repayment strategies like the snowball or avalanche method. The snowball approach focuses on paying off the smallest debts first, thereby gaining momentum, while the avalanche method targets high-interest debts first to decrease the overall interest paid.

-

Increasing Income: Look for opportunities to increase your income, such as taking on part-time work or freelancing. Additional income can be directed towards debt repayment, accelerating the timeline for achieving debt freedom.

Achieving a debt-free lifestyle requires commitment, but the rewards in terms of financial freedom and personal liberation make the effort worthwhile. By following these steps, you can take charge of your financial future and move towards a more stable and fulfilling life.

Building Strong Financial Habits: Budgeting and Saving

To sustain a debt-free lifestyle, it is imperative to cultivate strong financial habits, particularly in budgeting and saving. These habits act as the foundation upon which financial independence is built, ensuring long-term stability and security.

-

Budgeting: A well-structured budget is crucial for managing finances effectively. It helps track income and expenses, allocates funds for necessary expenditures, and ensures that resources are available for savings and investments. Regular review and adjustment of the budget are essential to accommodate life changes or unexpected financial challenges.

-

Saving: Savings should be a priority, not an afterthought. Establish an emergency fund to cover unforeseen expenses and prevent the accumulation of new debt. Additionally, set up savings goals for specific short-term and long-term needs, using savings accounts that offer competitive interest rates to maximize growth.

-

Financial Discipline: Strong financial habits require discipline and commitment. Avoid impulsive purchases that can derail budget plans and stick to financial strategies that support debt-free living. Making informed spending decisions becomes easier with the habitual application of discipline and forethought.

By building robust financial habits, one can maintain a debt-free lifestyle and lay the groundwork for achieving financial goals. Budgeting and saving not only secure your financial future but also enhance overall personal well-being, reinforcing the benefits of living debt-free.

Emotional Rewards: Gaining Confidence and Control of Your Life

Living debt-free yields significant emotional rewards, enriching one’s sense of confidence and control over personal and financial life. The empowerment that comes from knowing that one’s actions directly influence financial outcomes instills an unmatched confidence, fostering greater personal growth and satisfaction.

One of the foremost emotional rewards is the freedom from financial anxiety. Without the constant pressure of looming debt payments, individuals experience a profound sense of freedom, which translates to greater peace of mind. This state of serenity allows for deeper personal reflection, fostering emotional growth and resilience.

Moreover, achieving debt freedom enhances self-efficacy, the belief in one’s ability to execute plans and achieve goals. This newfound confidence extends beyond financial management, encouraging individuals to tackle other challenges with the assurance that they can succeed. As financial burdens lessen, individuals gain a clearer perspective on their capabilities, leading to greater personal development and fulfillment.

In essence, the emotional rewards of living debt-free extend well beyond the financial balance sheet. The confidence and control attained from this lifestyle pave the way for achieving broader life ambitions, underscoring the comprehensive benefits of personal liberation.

Minimalism and Debt-Free Living: How They Interconnect

Minimalism and debt-free living are closely linked philosophies, both advocating for simplicity and intentionality in life choices. Minimalism emphasizes reducing life’s excess and focusing on what truly matters, principles that align perfectly with the goals of achieving and maintaining a debt-free lifestyle.

At the heart of minimalism is the idea of prioritizing experiences and personal well-being over material possessions. This shift in focus from acquiring goods to enjoying experiences naturally supports a debt-free approach, as it reduces the unnecessary consumption that often leads to debt accumulation.

Living with less not only reduces expenditures but also highlights the importance of thoughtful financial management. Minimalism encourages the intentional allocation of resources, perfectly complementing the financial discipline required for living debt-free. By aligning expenditures with personal values and priorities, minimalism enables individuals to save more and reduce financial stress.

Additionally, the minimalist lifestyle reduces decision fatigue and promotes clarity, allowing better financial decision-making aligned with debt-free objectives. By embracing minimalism, individuals can effectively work towards debt freedom, enhancing their quality of life through simplification and intentional living.

Case Studies: Success Stories of People Who Achieved Debt Freedom

Real-life stories of individuals who have successfully navigated their way out of debt serve as inspiring examples of what can be achieved through determination and strategic planning. These case studies highlight different paths to financial independence, each underscoring the transformative power of living debt-free.

Case Study 1: The Young Professional

Jessica, a marketing executive in her late twenties, found herself burdened with student loans and credit card debt shortly after graduation. By implementing a strict budget and using the snowball method to tackle her smallest debts first, she managed to become debt-free within five years. Jessica credits her success to consistent budgeting, a side hustle, and a commitment to live below her means.

Case Study 2: The Family

The Johnsons, a family of four, faced substantial credit card and mortgage debt. They approached debt freedom by adopting a minimalist lifestyle, drastically reducing their expenses. Through careful budgeting and by selling unnecessary possessions, they managed to pay off their credit cards and significantly reduce their mortgage balance within six years, transforming their financial landscape.

Case Study 3: The Late Bloomer

In his late fifties, Tom was overwhelmed by business debt stemming from a failed venture. Determined to retire debt-free, he downsized his life, took on part-time work, and focused intensely on repaying his obligations. Within a decade, Tom was debt-free and able to retire comfortably, highlighting that it’s never too late to pursue and achieve financial freedom.

These success stories illustrate the diverse strategies and unwavering commitment needed to achieve debt freedom, proving that anyone can attain this goal regardless of their starting point.

The Long-term Impact of Debt-Free Living on Personal Well-being

Living debt-free not only provides immediate relief from financial stress but also delivers long-term benefits for personal well-being. These benefits manifest in various forms, including enhanced financial stability, improved mental health, and increased personal freedom, fundamentally transforming one’s life trajectory.

Firstly, the long-term financial stability that accompanies debt-free living creates a reliable foundation for future planning. Freed resources can be redirected towards savings and investment opportunities, thus fortifying financial security and enabling individuals to pursue long-term goals such as homeownership, education, and retirement planning.

Secondly, the mental health improvements resulting from a debt-free lifestyle offer enduring enhancements to quality of life. The alleviation of stress related to financial obligations reduces the likelihood of anxiety and depression, promoting healthier, more balanced living. The positive effects on mental health extend to stronger relationships, as financial tensions are a common source of stress in households.

Lastly, the personal freedom that accompanies financial independence allows for a broader range of life choices. Free from the constraints of debt, individuals can make decisions based on personal preferences and aspirations rather than financial limitations. This autonomy fosters a sense of empowerment and satisfaction, allowing for more fulfilling and purpose-driven lives.

Conclusion: Embracing Debt-Free Living as a Path to Personal Liberation

Embarking on the journey to debt-free living is a transformative decision with the power to unlock personal liberation in its truest form. It’s a commitment to long-term financial health and autonomy, which in turn brings profound improvements in personal well-being.

The path to a debt-free life requires dedication, strategic planning, and sometimes sacrifice, but the rewards are far-reaching. Not only does it offer financial stability, but it also enhances mental health, self-confidence, and personal fulfillment, making the pursuit of debt-free living worthwhile.

Ultimately, living debt-free is about reclaiming control over one’s life and finances, breaking free from the constraints of debt that limit personal possibilities. This lifestyle choice empowers individuals to live intentionally and to achieve personal liberation in modern life, reaffirming the immense potential and enrichment it offers.

FAQ

1. Can anyone achieve a debt-free lifestyle?

Yes, anyone can work towards a debt-free lifestyle, regardless of their current financial situation. It requires determination, financial discipline, and effective strategies like budgeting and debt repayment plans.

2. How long does it typically take to become debt-free?

The time it takes to become debt-free varies based on an individual’s financial situation, income, debts, and commitment to repaying those debts. Some achieve debt freedom in a few years, while for others, it may take longer.

3. Are there any tools to help manage and eliminate debt?

Numerous tools and apps are available to help manage debt, such as Mint, YNAB (You Need A Budget), and Debt Payoff Planner. These tools assist with budgeting, tracking expenses, and organizing debt repayment strategies.

4. How can minimalism support debt-free living?

Minimalism supports debt-free living by promoting a focus on essential needs, reducing unnecessary expenses, and encouraging a lifestyle that prioritizes experiences over material possessions, thus reducing debt accumulation.

5. What are some quick wins for starting on the debt-free journey?

Quick wins include creating a budget, cutting non-essential expenses, starting an emergency fund, and prioritizing debt repayment using strategies like the snowball method to gain momentum.

Recap

- Living debt-free offers personal liberation, transforming financial and personal well-being.

- Debt can significantly impact mental health, but achieving debt freedom alleviates stress and promotes peace of mind.

- Key steps involve assessment, budgeting, and strategic debt repayment.

- Building strong financial habits and adopting minimalism can support this lifestyle.

- Success stories highlight various pathways to achieving financial independence through debt freedom.

- Long-term benefits include financial stability, better mental health, and personal freedom.

References

- Ramsey, Dave. “The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness.” Thomas Nelson, 2013.

- Gottfurcht, Andrew. “Debt-Free Living: How to Get Out of Debt and Stay Out.” Heartfelt Books, 2018.

- Orman, Suze. “The Money Book for the Young, Fabulous & Broke.” Riverhead Books, 2007.

Deixe um comentário