Financial discipline is an essential life skill, yet it’s one that many of us struggle to master. Starting to build this discipline in your teens and twenties can set the foundation for a lifetime of financial security and independence. The path from receiving pocket money to earning a paycheck is a critical transition period where lifelong money habits are formed. This article explores how young individuals can cultivate smart money habits early on, ensuring they’re better prepared for the financial responsibilities that come with adulthood.

Understanding how to manage money effectively can seem daunting, especially when you’re just starting. However, the principles of financial discipline are straightforward and, once learned, can significantly impact your future Well-being. From learning basic financial terms to making your first investment, each step you take towards understanding and managing your finances can lead to greater independence and security.

The importance of starting young cannot be overstated. The habits formed and lessons learned during these formative years can influence your financial decisions for decades to come. Moreover, with the increasing complexity of the financial world, being financially literate is more important than ever. This article aims to provide an essential guide for teenagers and young adults to navigate their finances wisely, from pocket money management to making the most of their first paychecks.

By focusing on the fundamentals of financial planning, savings, and investment, young people can lay the groundwork for a prosperous future. Whether you’re a teenager looking to make the most of your pocket money or a young adult navigating your first job’s financial challenges, this guide offers practical advice and strategies to help you build a solid foundation of financial discipline.

Basic Financial Terms Every Young Person Should Know

Before diving into managing finances, it’s crucial to understand some basic financial terms. These terms provide the groundwork for making informed decisions about your money. Here are a few key terms every young person should know:

- Income: Money that you receive, typically through work, investments, or from gifts.

- Expenses: Money that you spend on anything from necessities like food and rent to luxuries like entertainment.

- Savings: Money that you set aside for future use, not spent on immediate needs or wants.

- Investments: Assets purchased with the intention of generating income or appreciation in value over time.

Understanding these terms can help you better manage your finances and plan for the future.

How to Manage Pocket Money Wisely: Tips for Teenagers

Managing pocket money is one of the first opportunities young people have to practice financial discipline. Here are some ways to do it wisely:

- Set Goals: Decide what you want to save for, whether it’s a new game, a phone, or future expenses.

- Budget: Allocate your money towards your goals, savings, and some spending money.

- Track Spending: Keep an eye on what you spend to avoid going over your budget.

This practice lays the foundation for managing larger sums of money in the future.

The Transition from Pocket Money to Your First Paycheck

Moving from pocket money to earning your first paycheck is a significant milestone. It brings new challenges and opportunities in managing your finances. To make this transition smoothly:

- Understand Your Paycheck: Familiarize yourself with terms like gross income, net income, taxes, and other deductions.

- Adjust Your Budget: Your increased income might mean new expenses, such as transportation to work, so plan accordingly.

- Start Saving Early: Even if it’s a small amount, regularly set aside part of your paycheck for savings.

These steps can help you adapt to your new financial situation without overwhelming yourself.

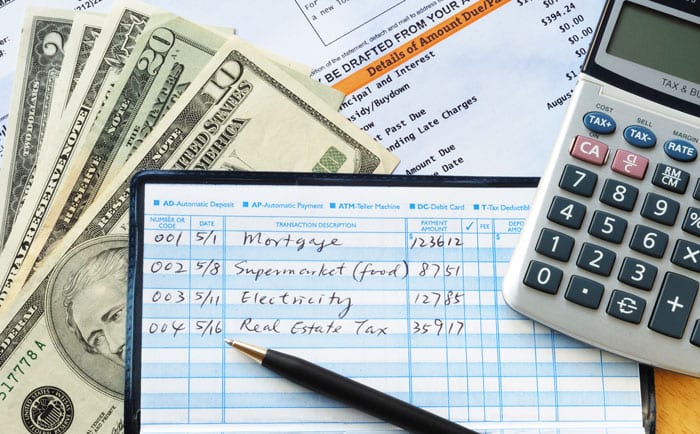

Essentials of Budgeting: How to Plan Your Spending and Savings

Budgeting is a critical skill in financial management. Here’s how to get started:

- Calculate Your Income: Include all sources, such as paychecks, gifts, and any other earnings.

- List Your Expenses: Divide them into necessities and wants to see where you can potentially cut back.

- Allocate Funds: Decide how much money to direct towards expenses, savings, and personal spending.

Sticking to a budget can help you live within your means and save for the future.

The Importance of an Emergency Fund and How to Start One

An emergency fund is crucial for financial security, providing a safety net in the face of unexpected expenses. To start one:

- Begin by saving a small, achievable amount from each paycheck.

- Aim to build your fund to cover several months of living expenses gradually.

- Keep the fund in a separate savings account to avoid the temptation to spend it.

This fund can offer peace of mind and protect against financial setbacks.

Credit Cards and Loans: How to Use Them Responsibly

Credit cards and loans can be useful financial tools if used wisely. To avoid debt:

- Only borrow what you can afford to repay.

- Pay your credit card balance in full each month to avoid interest charges.

- Understand the terms and conditions, including interest rates and fees.

Responsible credit use can help build a good credit score, important for future financial endeavors.

Investing Basics for Young Adults: Where to Begin

Investing can seem intimidating, but it’s a powerful way to grow your wealth over time. For beginners:

- Start Small: Investment apps and platforms often allow small initial investments.

- Educate Yourself: Learn about different types of investments, such as stocks, bonds, and mutual funds.

- Think Long-Term: Investments can fluctuate in the short term; focus on long-term growth.

Starting to invest early can take advantage of compound interest and increase your financial security.

Financial Habits That Can Secure Your Future

Adopting a few key financial habits can make a significant difference in securing your financial future:

- Live Within Your Means: Spend less than you earn and avoid unnecessary debt.

- Save Regularly: Make saving a consistent part of your financial routine, even if it’s a small amount.

- Plan for the Future: Consider long-term goals, like buying a house or retirement, and save accordingly.

These habits lay the foundation for financial independence and stability.

Finding the Right Financial Advice and Resources for Young People

With so much information available, finding reliable financial advice can be overwhelming. Look for resources tailored to young adults, such as financial blogs, books, and podcasts. Consider seeking advice from a financial advisor to guide specific to your situation.

Recap

- Understanding basic financial terms is the first step in managing your money effectively.

- Learning to manage pocket money can lay the groundwork for more significant financial responsibilities.

- Budgeting and saving are essential skills for financial discipline.

- An emergency fund provides a financial safety net.

- Credit cards and loans should be used responsibly to avoid debt.

- Investing can help grow your wealth over time.

- Adopting smart financial habits early can secure your future.

Conclusion

Building financial discipline in your teens and twenties is an invaluable investment in your future. By mastering the basics of managing money, budgeting, saving, and investing, young people can set the stage for financial independence and security. While the journey from pocket money to paychecks can be challenging, the habits and lessons learned along the way are crucial. Taking the time to learn and apply these principles can lead to a lifetime of financial Well-being.

As young adults navigate the complexities of the financial world, remember that patience, education, and persistence are key. Financial discipline isn’t about restricting your life; it’s about making informed choices that enable you to achieve your goals and dreams without financial stress. Start small, stay consistent, and keep your eyes on the future. With discipline and savvy, financial success is within reach for anyone willing to put in the work.

FAQ

- Why is financial discipline important?

Financial discipline helps you manage your money wisely, avoid debt, and save for future goals, leading to financial stability and independence. - How much should I save from my paycheck?

A general rule of thumb is to save at least 20% of your net income, but even small amounts can add up over time. - Can I start investing with a small amount of money?

Yes, many platforms allow you to start investing with small amounts, making it accessible for young adults to begin building their portfolios. - What’s the best way to build an emergency fund?

Start by saving a small, manageable amount from each paycheck, gradually increasing until you have enough to cover several months of expenses. - How can I use credit cards responsibly?

Pay off your balance in full each month, don’t spend more than you can afford, and understand the card’s terms and conditions. - What are some good resources for learning about finance?

Financial blogs, books tailored to young adults, podcasts, and financial education platforms can provide valuable information. - How do I create a budget?

List your income and expenses, categorize your spending, and allocate funds towards essentials, savings, and wants while adjusting as needed. - Is it too early to think about retirement savings in my twenties?

No, starting to save for retirement early can significantly impact the growth of your savings due to compound interest.

References

- “The Total Money Makeover” by Dave Ramsey – A guide to building a solid financial future.

- “I Will Teach You to Be Rich” by Ramit Sethi – Offers actionable advice for young adults on managing finances.

- Investopedia (Website) – Provides a wealth of information on financial terms, investing basics, and financial planning.

Deixe um comentário