Categoria: Tips

-

How to Create a Comprehensive Financial Plan for Your Family

Introduction to Family Financial Planning When it comes to securing your family’s future, few things are as important as solid financial planning. Creating a comprehensive financial plan for your family can seem daunting, but it’s a crucial step for ensuring long-term financial health and stability. Family financial planning involves assessing your current finances, setting goals,…

-

The Role of Insurance in Protecting Your Financial Future: A Comprehensive Guide

Introduction to Financial Security and Risk Management In an unpredictable world, achieving financial security is a top priority for many. While various strategies can help you build wealth, safeguarding what you have is equally crucial. This is where risk management comes in. Risk management involves identifying potential risks to your financial wellbeing and finding ways…

-

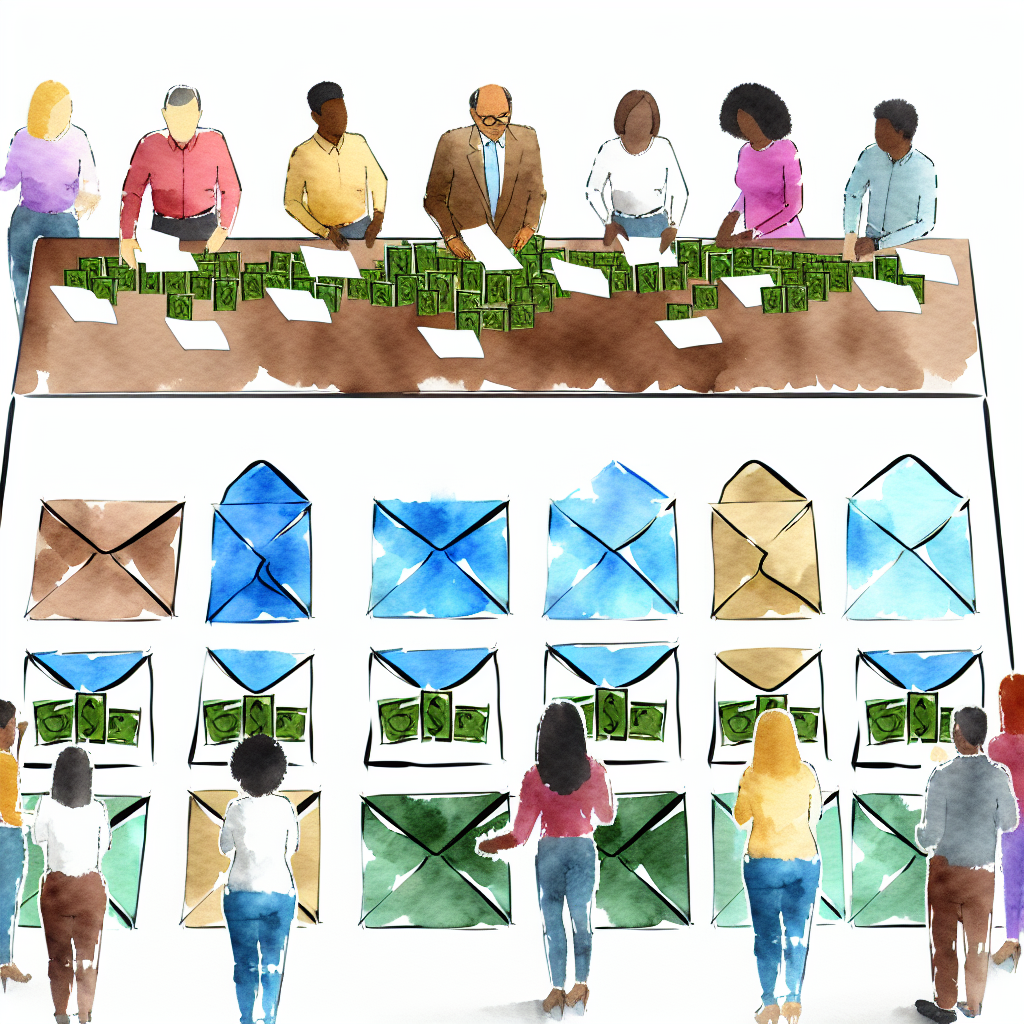

The Benefits of Using Cash Envelopes for Effective Budgeting

Introduction to Cash Envelope Budgeting Managing personal finances can often feel like an overwhelming task, filled with endless spreadsheets, digital apps, and a constant juggling act between income and expenses. In an age where technology dominates every aspect of our lives, budgeting tools are mostly digital. However, an old-school method is making a remarkable comeback:…

-

The Benefits of Automatic Savings Plans for Financial Stability

Introduction to Automatic Savings Plans In today’s fast-paced world, financial stability is a goal many strive to achieve. However, with various expenses, bills, and spontaneous purchases, saving money consistently can be a challenge. One effective solution to this problem is the adoption of automatic savings plans. An automatic savings plan is a strategy where funds…

-

How to Save Money on Groceries: Tips and Tricks for Every Shopper

Introduction: The Importance of Saving Money on Groceries Grocery shopping can be a significant part of your household budget, often taking a larger chunk than anticipated. With the rising cost of food and basic necessities, saving money on groceries can make a substantial difference in your overall financial health. Carefully managing your grocery expenses can…

-

The Critical Role of Insurance in Comprehensive Financial Planning

Introduction to Financial Planning Financial planning is an organized process that aims to manage financial resources to achieve life goals. These goals might include purchasing a house, funding education, or ensuring a comfortable retirement. The modern economy, with its complexities and uncertainties, necessitates a structured approach to money management. Financial planning, as a discipline, offers…

-

Top 9 Benefits of Using a Credit Card Responsibly

Introduction to the Importance of Credit Card Responsibility Credit cards have become an essential tool in modern financial management. They offer a range of benefits that can enhance your financial flexibility and purchasing power. However, the perks of credit card usage can be fully realized only when used responsibly. Mismanagement can lead to spiraling debt,…

-

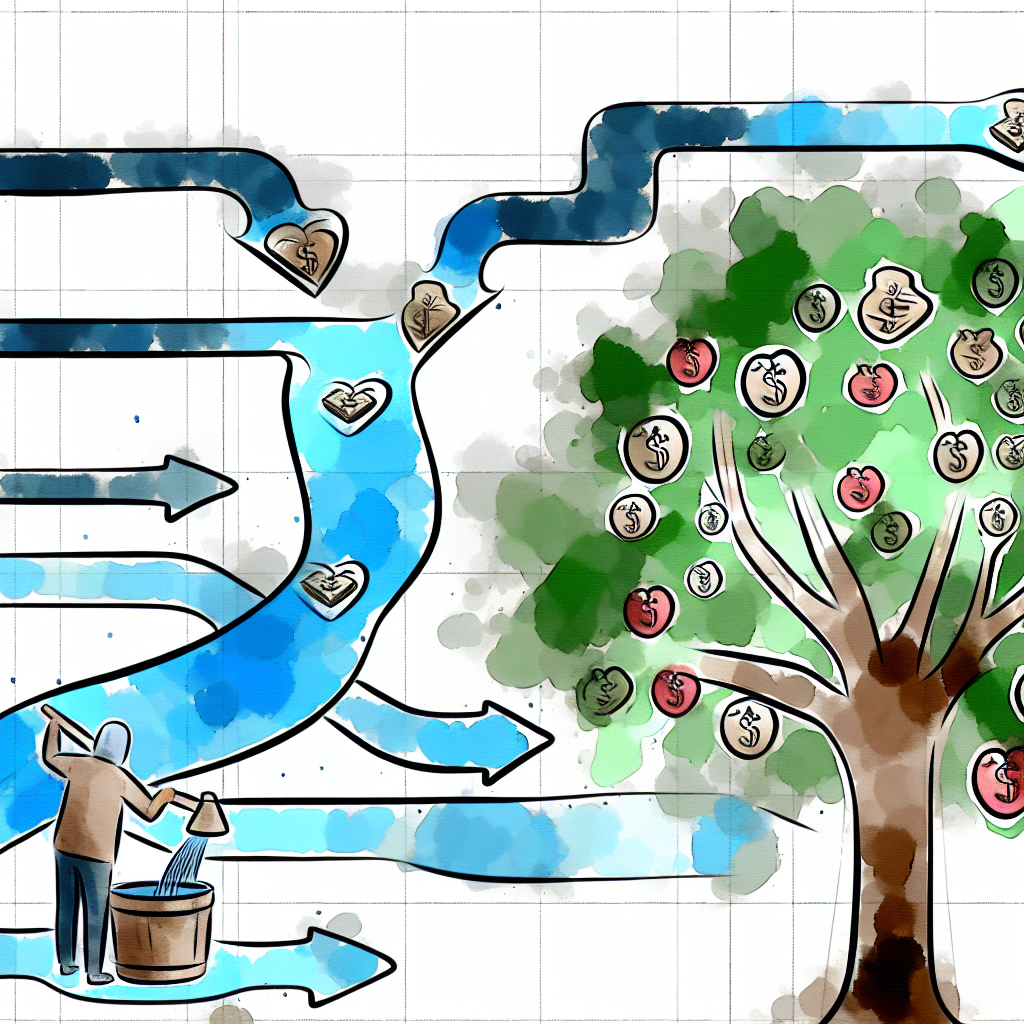

Understanding How Compound Interest Works for Financial Growth

Introduction to Compound Interest Understanding the intricacies of financial growth is pivotal for anyone looking to build wealth over time. One foundational concept that stands at the forefront of personal finances and investment strategies is compound interest. Whether you are a novice trying to understand how your savings account works, or an investor looking to…

-

How to Create Multiple Streams of Income: A Comprehensive Guide

Introduction to Multiple Streams of Income In today’s rapidly evolving economy, relying solely on a single source of income can be risky. Economic downturns, job losses, and unexpected expenses can significantly impact financial stability. To mitigate these risks and build a more secure financial future, many individuals are turning to multiple streams of income. This…

-

Effective Strategies to Pay Off Credit Card Debt Quickly

Introduction: Understanding the Impact of Credit Card Debt The allure of credit cards is undeniable. From the ease of transaction to the promise of rewards, it’s no wonder that millions of people turn to this form of payment for daily purchases and big-ticket items alike. However, this convenience often comes at a more significant cost…