Categoria: Personal finances

-

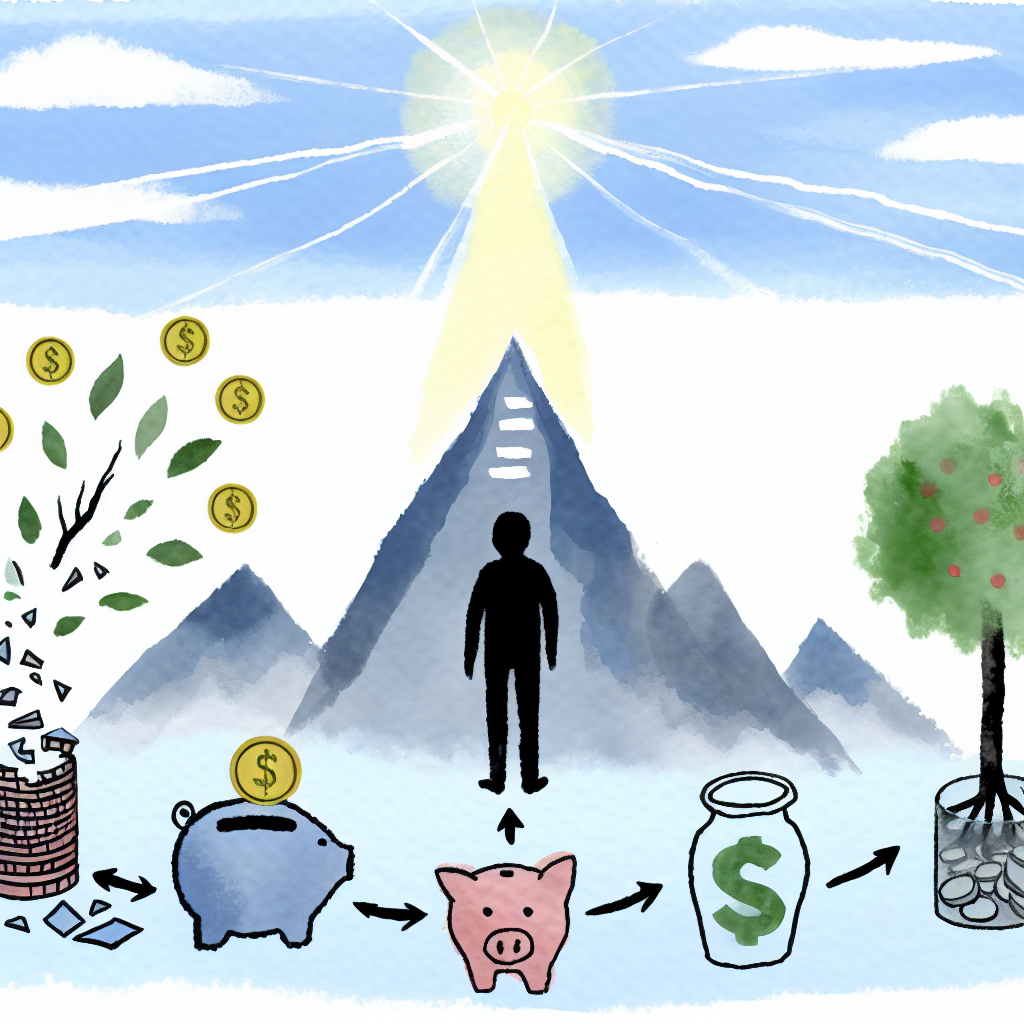

How Financial Self-Discipline Leads to Personal Empowerment

Introduction to Financial Self-Discipline: A Path to Empowerment Financial self-discipline is more than a buzzword; it’s a life-altering practice that propels individuals toward personal empowerment. In today’s fast-paced world, where consumerism often dwarfs financial prudence, self-discipline stands as a counterbalance. By mastering financial self-discipline, one not only accrues monetary benefits but also gains control over…

-

Understanding the Emotional Rewards of Paying Off Debt Early

Introduction: Why Paying Off Debt Early Matters In today’s fast-paced world, debt has become an almost unavoidable part of life. From student loans to credit card bills, mortgages to car loans, debt often seems like a natural consequence of pursuing life’s goals. However, what often isn’t discussed is the emotional weight that comes alongside the…

-

The Importance of Regularly Reevaluating Your Financial Goals

Introduction to the Importance of Setting Financial Goals Financial goals are an essential component of a sound financial plan. They serve as a roadmap for managing personal finances and achieving specific objectives that improve both short-term comfort and long-term security. Setting clear financial goals not only helps individuals allocate resources more effectively but also motivates…

-

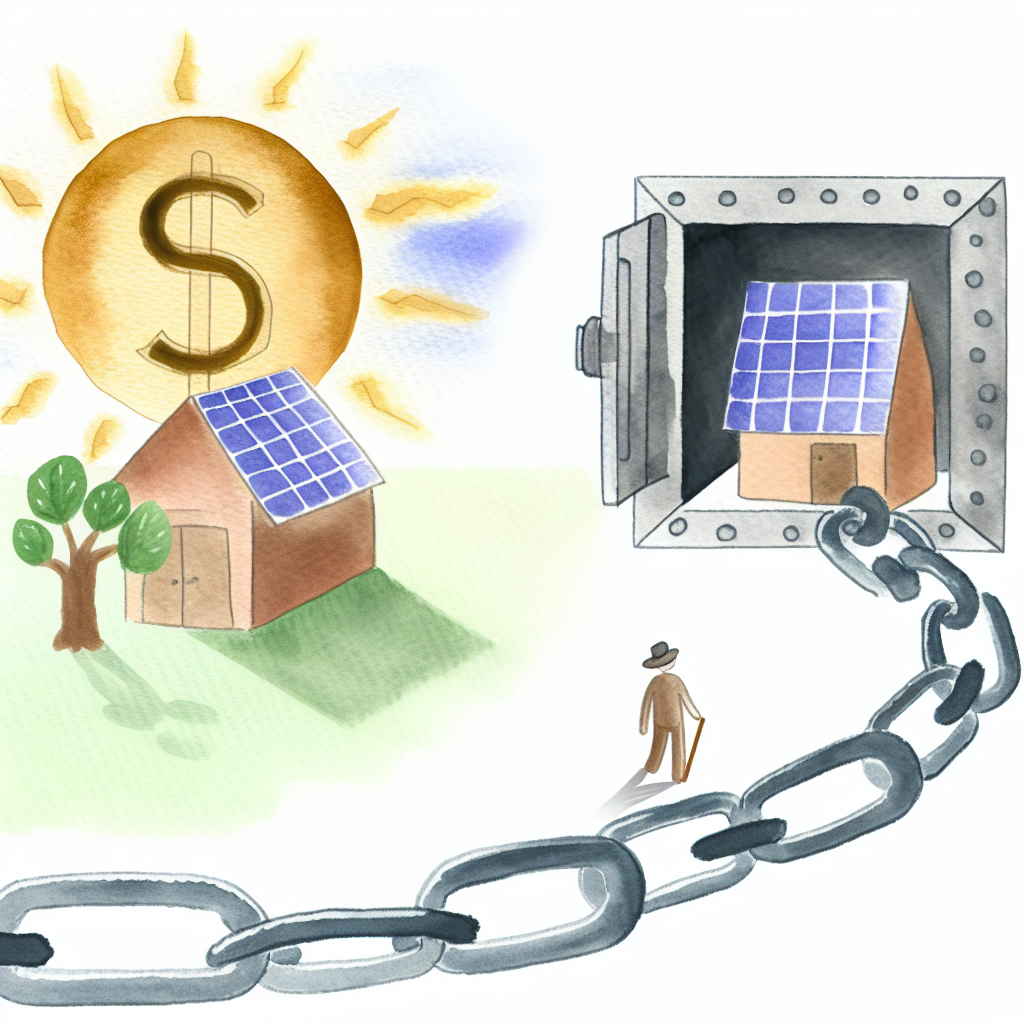

How to Build a Diverse Investment Portfolio for Long-Term Success

Introduction to Investment Diversification In the realm of personal finance and investment, diversification emerges as a key strategy to mitigate risk and enhance growth potential over the long term. At its core, investment diversification involves spreading investments across various financial instruments, industries, and other categories to reduce exposure to risk. The rationale behind diversification is…

-

How to Build Credit Responsibly Without Falling Into Debt

Building credit is a fundamental step in establishing financial stability. Whether you’re preparing to rent a home, buy a car, or secure a job that checks your credit report, maintaining good credit health is crucial. However, many people find the process daunting, worried that they might fall into debt while trying to improve their credit…

-

How to Stay Motivated on Your Debt-Free Journey: Proven Strategies and Tips

Introduction Embarking on a journey toward financial freedom is a commendable endeavor, yet it’s fraught with challenges that can drain your enthusiasm and resolve. Many people start off on their debt-free journey fueled by determination but often find themselves bringing up the rear due to diminishing motivation. Understanding how to stay motivated throughout this process…

-

Harnessing the Power of Financial Minimalism to Achieve Personal Freedom

In a world where consumerism reigns and the constant push for more—more of anything and everything—dominates, many individuals are starting to seek an alternative path. This path focuses not on accumulation but on simplification, leading to a movement known as financial minimalism. Financial minimalism proposes a lifestyle shift that can significantly alter one’s approach to…

-

The Power of Setting Clear Financial Boundaries: A Guide for Personal and Professional Growth

Introduction In today’s fast-paced world, managing personal finance is becoming increasingly crucial. Financial boundaries are the limits or guidelines we set for ourselves regarding how we spend, save, and share our money. They serve as a form of self-care, allowing individuals to shield themselves from financial stress and external pressures. Understanding and setting these boundaries…

-

How the Power of a Growth Mindset Drives Financial Success

How the Power of a Growth Mindset Drives Financial Success In a fast-paced world characterized by technological advancements and economic volatility, the path to financial success has become more complex and demanding than ever. For financial aspirants, a growth mindset represents a powerful cognitive asset that can significantly impact their journey toward financial well-being. But…

-

The Impact of Consistent Saving Habits on Long-Term Financial Success

Introduction: Importance of Saving Habits In today’s fast-paced world, financial stability is a cornerstone of a stress-free lifestyle. Building wealth and achieving long-term financial success often revolve around one pivotal practice: consistent saving habits. Saving isn’t merely a choice; it’s a crucial pillar for securing future financial health and providing a buffer against inevitable economic…