Categoria: Personal finances

-

How to Prioritize Savings While Paying Off Debt: A Comprehensive Guide

Introduction to the Importance of Balancing Savings and Debt Repayment Balancing savings and debt repayment is a challenge that most individuals face at some point in their financial journey. This topic is of paramount importance because it affects not only your current financial wellbeing but also your long-term financial stability and freedom. Prioritizing savings while…

-

How to Avoid Financial Burnout While Managing Debt Effectively

Introduction Managing debt can be a daunting task, one that requires not only financial acumen but also emotional resilience. As modern life becomes increasingly expensive and complex, more people find themselves juggling various forms of debt—from student loans to credit card balances. While managing these debts is crucial for financial stability, it can also lead…

-

Exploring the Psychological Benefits of Achieving Financial Stability

Introduction to Financial Stability and Mental Health In today’s fast-paced world, the concept of financial stability reaches far beyond having a steady income. It’s an integral component of mental and emotional well-being. This stability doesn’t merely mean having money saved but encompasses a comprehensive understanding of finances that enables individuals to lead a stress-free and…

-

How Your Daily Habits Shape Your Financial Future: A Comprehensive Guide

Introduction: The Connection Between Habits and Financial Success It’s often said that we are the sum of our habits, and nowhere is this more apparent than in the realm of personal finance. Daily habits are the small forces that shape our financial well-being over the long haul. Every purchase, every saving decision, and every financial…

-

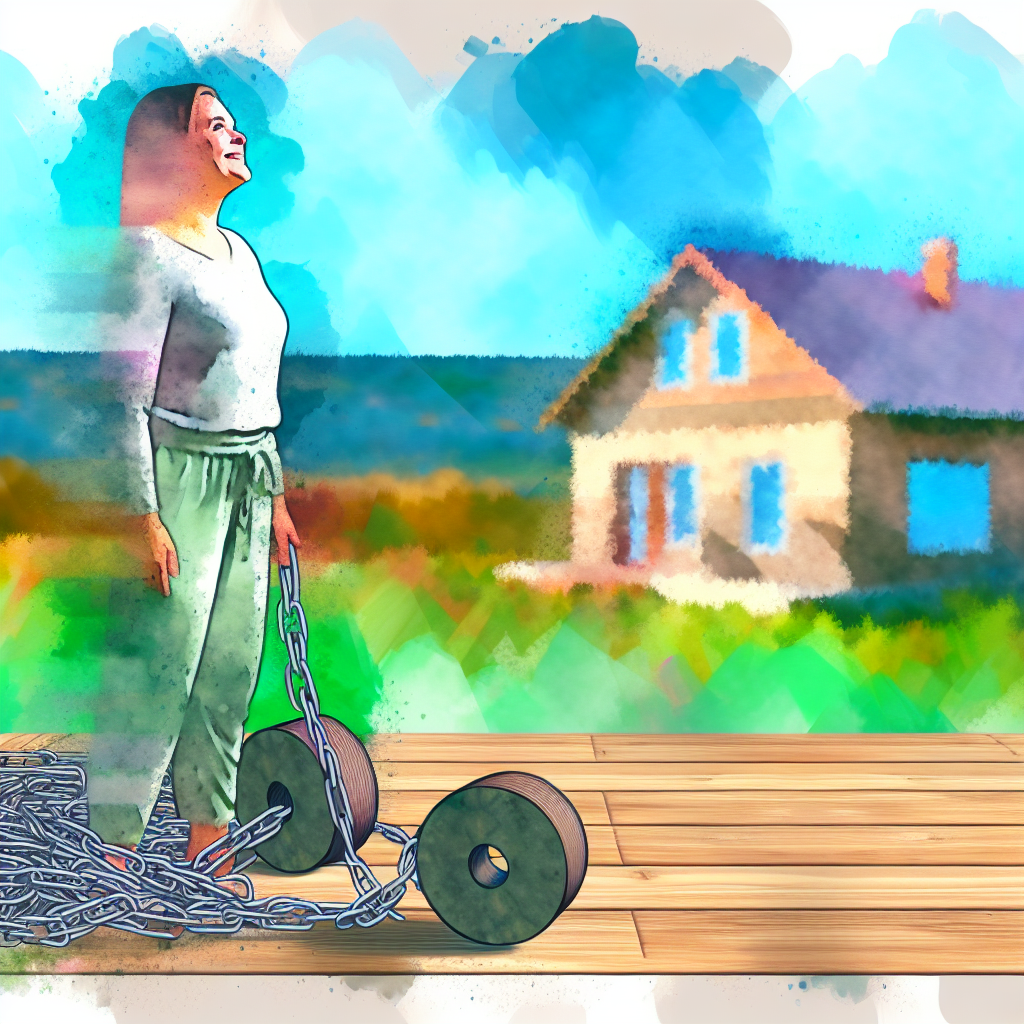

How Living Debt-Free Unlocks Personal Liberation in Modern Life

How Living Debt-Free Unlocks Personal Liberation in Modern Life Introduction to Living Debt-Free: Understanding the Concept In today’s fast-paced world, financial obligations often weigh heavily on individuals, tethering them to a cycle of earnings and expenses that seem never-ending. The concept of living debt-free offers a path out of this cycle, promising a life unshackled…

-

How to Prioritize Financial Security in Uncertain Economic Times

Introduction to Financial Security In today’s rapidly changing world, the concept of financial security takes on paramount importance. The global landscape is marked by economic fluctuations, geopolitical tensions, and unforeseen challenges that underscore the necessity of shoring up our financial foundations. Financial security isn’t merely about having sufficient funds in the bank; it’s about having…

-

How Tracking Your Spending Boosts Financial Awareness and Improves Your Budgeting Skills

Introduction to Financial Awareness Becoming financially aware is a crucial step toward achieving financial independence and security. Financial awareness involves having a clear understanding of your financial situation, including your income, expenses, assets, and liabilities. It allows individuals to make informed decisions regarding their money management, saving strategies, and investment options. In essence, it provides…

-

Understanding the Power of Saying No to Unnecessary Purchases for Financial Freedom

Understanding the Power of Saying No to Unnecessary Purchases for Financial Freedom In today’s consumer-driven society, the concept of saying no to unnecessary purchases might seem daunting, yet it plays a crucial role in achieving financial freedom. Many people find themselves trapped in a cycle of overspending due to impulsive buying habits and societal pressures.…

-

How to Build Credit Without Overspending: Smart Strategies for Financial Growth

Understanding and effectively managing your credit is a cornerstone of sound financial health and independence. Many are daunted by the concept of credit building, mistakenly believing that it’s tied to heavy spending or risky debt accumulation. However, this couldn’t be further from the truth. The reality is that building credit is about making strategic, informed…

-

How Understanding Taxes Can Enhance Your Financial Planning

Introduction to the Importance of Tax Knowledge In the rapidly evolving world of personal finance, understanding taxes has emerged as a crucial skill. While taxes might seem mundane or overwhelmingly complex, they are an integral part of financial planning. Gaining comprehensive tax knowledge empowers individuals to optimize their financial strategies, leading to improved monetary health…