Understanding how to build wealth is a goal that many people aspire to achieve. However, the path to financial prosperity is not solely about increasing your income; it’s also about managing your finances effectively. One of the biggest obstacles to financial growth is a phenomenon known as lifestyle inflation. This insidious trend can sabotage even the most promising wealth-building efforts if left unchecked.

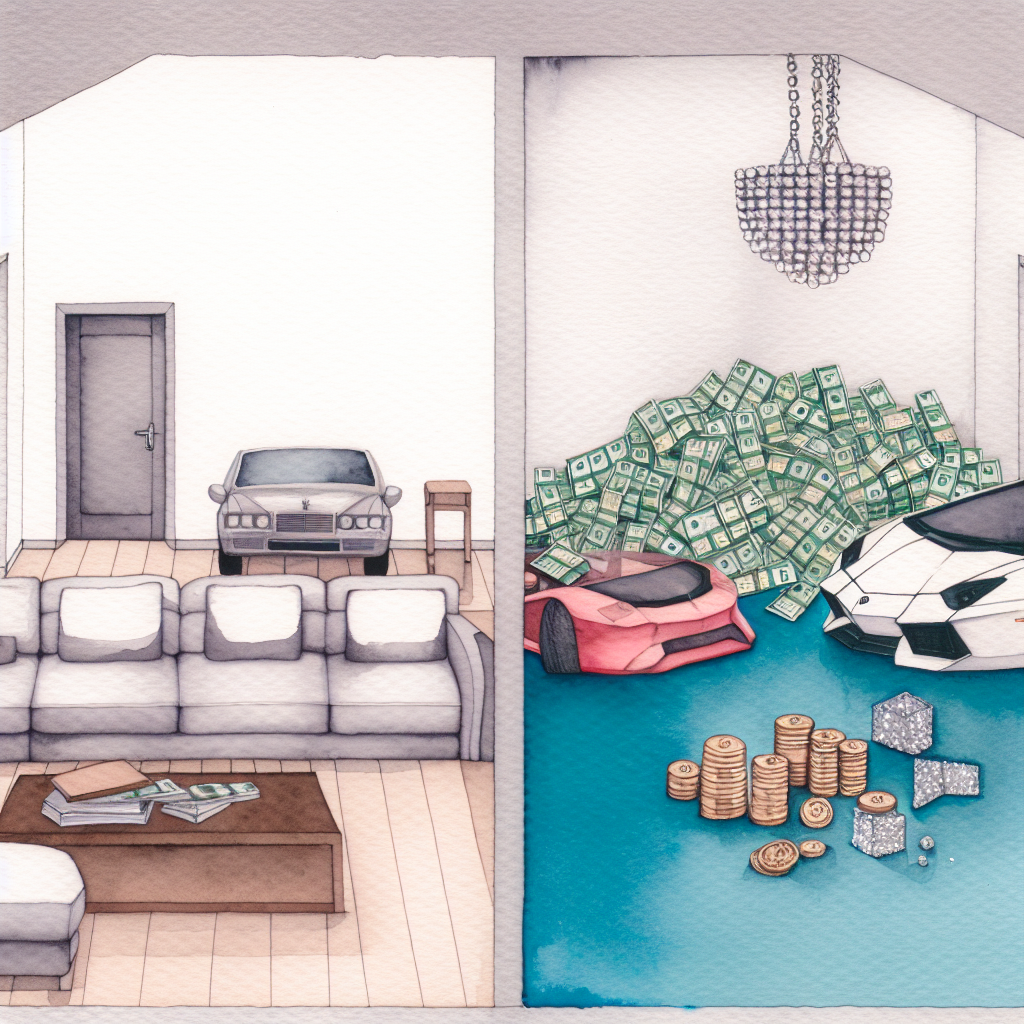

Lifestyle inflation refers to the gradual increase in spending that often accompanies an increase in income. As individuals earn more, they tend to upgrade their living standards, buying more expensive items and indulging in luxuries that they previously managed without. While it may seem harmless at first, this habit can significantly impede long-term financial growth, as these increased expenses can prevent you from saving or investing your newfound income.

To really understand and control lifestyle inflation, it’s essential first to identify the triggers and understand its impact on wealth-building strategies. This requires a shift in mindset, focusing on differentiating between needs and wants to ensure that financial decisions align with broader life goals. By prioritizing savings and investments over luxurious living, you’re setting the stage for significant wealth accumulation over time.

This guide will delve into the concepts of lifestyle inflation, offering practical advice on how to prevent it from undermining your financial health. We will explore the mindset required to combat this issue, provide strategies to implement a budget conducive to wealth growth, and share real-life success stories that prove building wealth through mindful financial management is achievable.

Understanding Lifestyle Inflation and Its Impact on Wealth Building

Lifestyle inflation occurs when an individual’s spending increases as their income grows. While it’s natural to want to enjoy the benefits of a higher paycheck, failing to control your expenses can have severe implications on your ability to build wealth. When spendings rise in tandem with income, little if any of the financial surplus gets allocated to savings or investments, ultimately impeding financial independence.

The primary impact of lifestyle inflation on wealth building is the reduction in the amount of money that could have been invested to generate additional income. The more you spend on lifestyle upgrades, the less you save and invest for your future. This habit undermines compound growth—the powerful driver behind wealth accumulation—which requires time and consistent contributions to be effective.

Worse yet, lifestyle inflation often snowballs into unsustainable financial practices. When living expenses rise beyond reasonable limits, individuals are forced to maintain a higher income just to “afford” their chosen lifestyle. This can lead to financial stress, increased debt, and a delayed retirement. Understanding the detrimental effects of lifestyle inflation is the first step towards curbing its impact and paving a way toward a more secure financial future.

Identifying Triggers of Lifestyle Inflation

Recognizing what prompts lifestyle inflation is crucial to curbing it. These triggers vary from person to person but often include:

- Increased income: A salary raise, promotion, or bonus can tempt individuals to upgrade their lifestyle.

- Peer pressure: The perceived need to “keep up with the Joneses” can lead people to spend more on luxuries and appearances.

- Social media influence: Platforms showcasing the lavish lifestyles of others can distort perceptions of what is necessary versus extravagant.

- Life changes: Major life events such as marriage, having children, or moving to a new city often bring with them the desire, or perceived necessity, to increase spending.

Identifying these triggers allows individuals to build strategies to counteract them. Maintaining awareness is key; when income increases, consciously decide to allocate a significant portion of it toward savings and investments instead of expenses. Understanding your personal triggers can also help in setting ground rules to resist unnecessary spending during pivotal financial moments.

Differentiating Between Needs and Wants

A core tenet of preventing lifestyle inflation lies in the ability to differentiate between needs and wants. Needs are essential costs like housing, food, and utilities, while wants are non-essential expenses such as luxury goods and entertainment. The blurred line between these categories can sometimes lead individuals to justify overspending on wants, viewing them as needs.

To effectively differentiate, create a detailed list split into these two categories. Regularly evaluate your spending to ensure that your funds are being allocated primarily to needs. This practice aids in eliminating unnecessary costs and can drive more funds into savings and investment accounts.

Another strategy involves setting a budget that allocates a fixed percentage of income towards each category. For example, the 50/30/20 budget rule suggests spending 50% of your income on needs, 30% on wants, and directing 20% towards savings and debt repayment. By clearly defining these boundaries, you empower yourself to manage money more effectively.

Creating a Solid Financial Plan

A solid financial plan is the backbone of effective wealth building. It provides clear strategies and frameworks for saving, spending, and investing money, ensuring that lifestyle inflation does not derail financial goals.

To craft a robust financial plan, start by setting realistic financial goals. These can range from building an emergency fund, saving for retirement, or investing in the stock market. Your plan should map out the specific actions needed to achieve each goal, complete with timelines and milestones.

Incorporate risk management strategies to protect your financial well-being, such as insurance and emergency savings. Consistently review and adapt your plan to reflect life changes, economic fluctuations, or shifts in personal priorities. A well-thought-out financial plan is a proactive step in safeguarding against lifestyle inflation and keeping you on track toward wealth accumulation.

Emphasizing the Importance of Saving and Investing

Saving and investing are critical components in combatting lifestyle inflation and building wealth. These practices ensure that surplus income contributes to future financial growth rather than immediate consumption.

It’s essential to prioritize the creation of an emergency fund to cover unexpected expenses such as medical emergencies or job loss. This fund acts as a financial buffer, protecting you from being forced to rely on credit cards or loans in challenging times.

Once an emergency fund is established, focus on investing. Investments offer the chance to generate passive income and benefit from compound interest over time. Whether it’s through stock markets, real estate, or mutual funds, diversifying your investment portfolio is key to minimizing risk and maximizing returns. By continually funneling a portion of income into savings and investments, you effectively curb lifestyle inflation and promote long-term wealth growth.

Strategies to Combat Lifestyle Inflation

To effectively combat lifestyle inflation, consider implementing the following strategies:

-

Automate savings: Set up automatic transfers from your paycheck into savings and investment accounts. This ensures a portion of your income is directed towards wealth growth before you have the chance to spend it.

-

Limit indebtedness: Avoid increasing debt to sustain a lavish lifestyle. Pay off existing debts and focus on living within your means.

-

Regular financial reviews: Conduct monthly or quarterly assessments of your spending habits, adjusting areas where lifestyle inflation might be creeping in.

-

Adopt a thrifty mindset: Embrace a minimalist lifestyle, appreciating life’s simple pleasures and prioritizing experiences over material possessions.

-

Delay gratification: Before making significant purchases, wait for a predetermined period to assess if the item is a need or simply a want. This period often reveals impulsive buying tendencies and helps avoid unnecessary expenses.

By embedding these strategies into your routine, you can safeguard against the subtle advances of lifestyle inflation.

Implementing a Budget That Supports Wealth Building

Creating and sticking to a comprehensive budget is one of the most effective measures against lifestyle inflation. A well-planned budget acts as a guiding framework, helping you allocate resources effectively and resist overspending.

Sample Budget Table

| Category | Budget Percentage | Allocation Strategy |

|---|---|---|

| Housing | 25-30% | Prioritize affordable housing options |

| Savings & Investments | 15-20% | Automatic deductions and diversified portfolios |

| Utilities | 5-10% | Monitor usage and seek cost-efficient alternatives |

| Debt Repayment | 5-15% | Focus on eliminating high-interest debts first |

| Miscellaneous Wants | 10-15% | Restrict to discretionary spending |

| Groceries & Transport | 10-20% | Opt for cost-effective solutions and carpooling if possible |

Start by categorizing your expenses into fixed (needs) and variable (wants) costs. Set realistic spending limits for each category and track your monthly expenses using apps or budgeting software that offer insights into spending patterns. This process not only highlights areas where you might cut back but also shows how reallocations can increase savings and investment contributions.

Setting Financial Goals and Priorities

Financial goals are crucial for maintaining focus and motivation throughout your journey to wealth. They serve as benchmarks against which progress is measured and help to clarify financial priorities.

Begin by dividing your goals into short-term and long-term categories. Short-term goals might include saving for a vacation or building an emergency fund, while long-term goals could involve saving for retirement or purchasing a home. Define each goal clearly, including a target amount and expected completion date.

It’s important to prioritize goals based on urgency and importance. Start by addressing high-priority goals that secure your financial stability, such as debt reduction and emergency savings, before moving on to lower priority wants like luxury items. Consistent progress towards sound financial objectives paves the way for comprehensive wealth growth over time.

Exploring Budget-Friendly Alternatives for Expenses

Living within your means doesn’t have to mean sacrificing quality of life. Countless budget-friendly alternatives exist to reduce expenses without compromising comfort or happiness.

- Housing: Consider downsizing, house sharing, or relocating to more affordable areas.

- Transportation: Use public transport, carpooling, or cycling instead of owning a high-maintenance vehicle.

- Dining: Opt for home-cooked meals and limit restaurant visits to special occasions.

- Entertainment: Take advantage of free community events and cost-effective streaming services instead of expensive cable subscriptions.

- Travel: Book flights during off-peak seasons and utilize reward points or discounts wherever possible.

Seeking affordable alternatives reinforces a disciplined financial mindset and frees up funds for savings and investments, promoting the long-term accumulation of wealth.

The Role of Mindset in Preventing Lifestyle Inflation

Ultimately, the key to overcoming lifestyle inflation lies in fostering a mindset oriented towards long-term financial health. Understanding that true wealth isn’t measured by material possession but by financial security allows for a shift in values and priorities.

- Gratitude: Cultivate an appreciation for the things you already have, reducing the desire for constant upgrades.

- Mindfulness: Practice conscious spending by reflecting on purchases and their alignment with your financial goals.

- Education: Continuously educate yourself on personal finance topics to enhance your money management abilities.

- Resilience: Be prepared to resist societal pressures to spend more than necessary, staying focused on your long-term objectives.

Mindfully managing your desires can effectively curb lifestyle inflation, providing a clear path to sustained financial growth and prosperity.

Success Stories: Real-Life Examples of Avoiding Lifestyle Inflation

Success stories serve not only to inspire but also to demonstrate that avoiding lifestyle inflation is both realistic and rewarding.

The Thompson Family: After receiving a considerable income boost through promotions, the Thompsons decided against upgrading to a larger home, choosing instead to invest in rental properties. This decision led to additional income streams and accelerated their journey to financial independence.

Jenna’s Story: Jenna, a young entrepreneur, committed to living below her means even as her earnings grew. By directing surplus income into ETFs and retirement accounts, Jenna was able to retire at 45—much earlier than her peers.

Mike and Emily: Despite their rising salaries, this couple kept their focus firmly on minimizing lifestyle inflation. They prioritized travel over physical possessions, budgeting meticulously for experiences and ensuring they met their financial goals before indulging in luxuries.

These stories highlight the positive outcomes achievable through disciplined financial management and resisting societal expectations.

Frequently Asked Questions

What is lifestyle inflation?

Lifestyle inflation refers to the tendency to increase spending as income rises, leading to a higher cost of living that can impede long-term wealth accumulation.

How does lifestyle inflation affect financial growth?

Lifestyle inflation reduces the amount of money available for savings and investments, limiting potential for wealth growth and leading to potential financial strain if expenses surpass income.

Can lifestyle inflation be completely avoided?

While completely avoiding lifestyle inflation is challenging, mindful spending, budgeting, and financial education can significantly mitigate its effects and support wealth building.

Why is differentiating between needs and wants critical?

Distinguishing needs from wants is crucial to effective budgeting and spending, ensuring that financial resources are allocated towards essentials rather than luxury items.

How do financial goals help in combating lifestyle inflation?

Financial goals provide structure and motivation to resist frivolous spending and prioritize saving and investing, thus reducing the impact of lifestyle inflation on wealth growth.

Recap of Main Points

- Lifestyle inflation is a major barrier to wealth building, stemming from increased expenses accompanying income growth.

- Recognizing triggers and differentiating between needs and wants are crucial steps in managing lifestyle inflation.

- A solid financial plan, emphasis on savings and investing, and an effective budget form the foundation of sound financial management.

- Strategies such as automating savings, limiting debt, and exploring budget-friendly alternatives are effective in combating lifestyle inflation.

- Mindset plays a pivotal role, with a focus on gratitude, mindfulness, and financial education supporting long-term financial health.

References

- “The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness” by Morgan Housel

- “Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence” by Vicki Robin

- “Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!” by Robert T. Kiyosaki

Conclusion

To summarize, lifestyle inflation can substantially hinder your journey to wealth if not addressed. Its subtle ability to increase expenses alongside income necessitates a proactive approach that involves understanding its triggers, differentiating needs from wants, and adopting disciplined financial practices.

By creating a comprehensive financial plan that prioritizes saving and investing, you set the foundation for future financial security. Cultivating a mindset focused on long-term wealth over immediate pleasures further ensures sustainable economic health.

In pursuing strategies to prevent lifestyle inflation, you not only carve a path toward substantial wealth growth but also create a life grounded in financial independence and peace of mind. These measures bolster resilience in the face of economic challenges and ensure the cultivation of lasting wealth for years to come.

Deixe um comentário