Introduction to Multiple Streams of Income

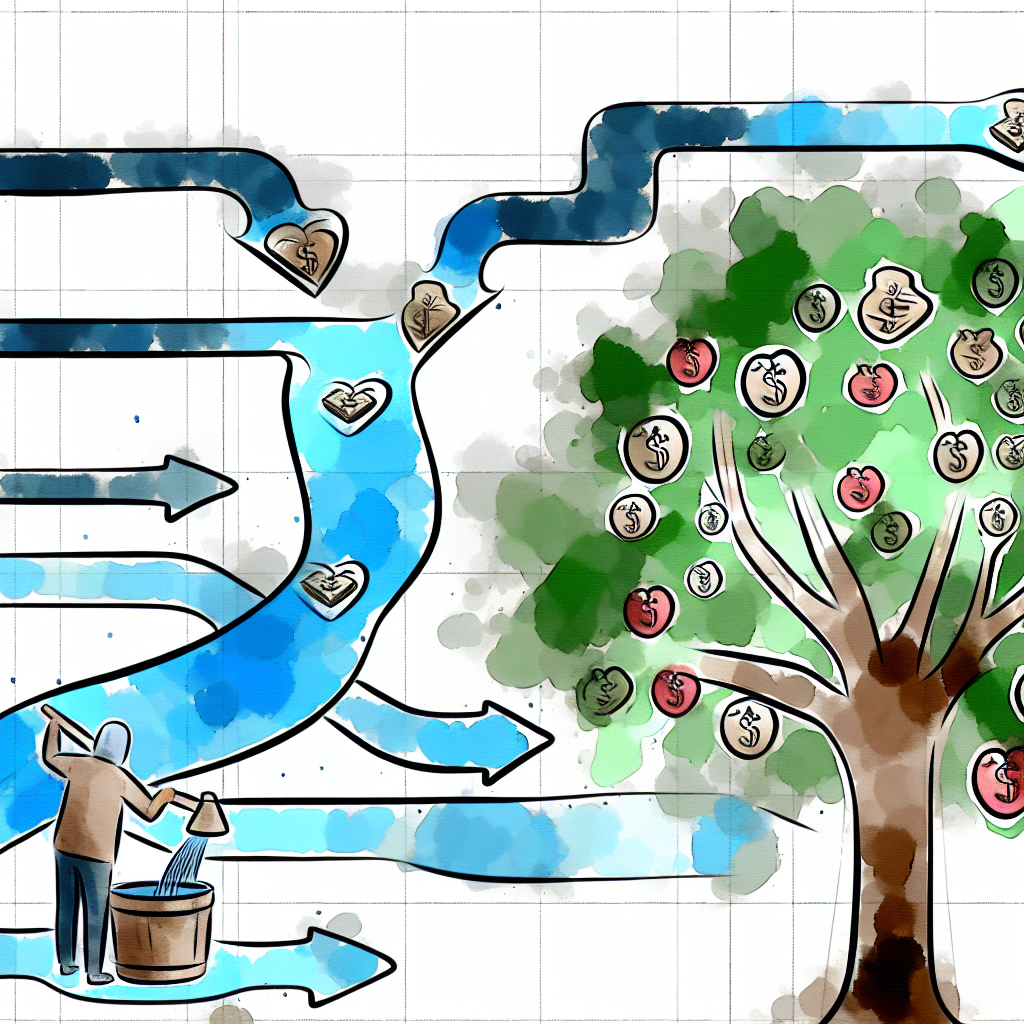

In today’s rapidly evolving economy, relying solely on a single source of income can be risky. Economic downturns, job losses, and unexpected expenses can significantly impact financial stability. To mitigate these risks and build a more secure financial future, many individuals are turning to multiple streams of income. This strategy involves creating various sources of revenue, allowing for greater financial resilience and the potential for increased wealth.

Creating multiple streams of income is not a novel concept. Historically, people have engaged in various activities to generate revenue, from farming and trading to investments and side businesses. However, the digital revolution has significantly expanded the opportunities available for earning money beyond traditional employment. From freelancing and consulting to e-commerce and online courses, the possibilities are virtually limitless.

The process of establishing multiple income streams requires careful planning, dedication, and a willingness to explore new avenues. It’s not merely about earning more money but about creating a sustainable, diversified financial ecosystem that can weather economic fluctuations. By understanding your skills, interests, and the available opportunities, you can strategically build a diversified income portfolio that aligns with your goals and lifestyle.

In this comprehensive guide, we will explore why diversifying income sources is crucial, how to identify your skills and interests, and various avenues for creating additional income streams. Whether you’re looking to supplement your existing income or achieve financial independence, this guide provides valuable insights and actionable strategies to help you succeed.

Why Diversifying Income Sources is Important

Diversifying your income sources is a fundamental principle of sound financial management. It provides a safety net that can protect you from unexpected financial setbacks. Here are several key reasons why diversifying income sources is important:

First and foremost, diversification reduces financial risk. By having multiple streams of income, you are not solely dependent on one source. In the event of a job loss or a downturn in one area, other income sources can help maintain your financial stability. This can be particularly important in uncertain economic times, where job security is not guaranteed.

Secondly, multiple streams of income can significantly enhance your financial growth and wealth-building potential. Different income sources can generate varying amounts of revenue, and collectively they can significantly boost your overall earnings. This additional income can be used to invest, save, or spend on things that matter most to you, contributing to a higher quality of life.

Lastly, having diversified income streams can provide greater financial flexibility and freedom. It allows you to pursue passions and interests that might not be possible with a single income source. For instance, you could work a part-time job while building a business, or freelance in a field you love while maintaining traditional employment. This flexibility can lead to a more fulfilling and balanced life, where you’re not completely tied to one job or career path.

Identifying Your Skills and Interests

Before you can begin creating multiple streams of income, it’s essential to identify your skills and interests. This process involves a thorough self-assessment to understand where your strengths and passions lie, as these will guide you in choosing the most suitable and enjoyable income-generating activities.

Start by listing your professional skills and personal talents. Consider your educational background, work experience, and any hobbies or activities you excel in. Think about what tasks you enjoy doing and find fulfilling. This comprehensive list will help you identify potential areas where you can monetize your expertise or passions.

Next, consider the market demand for these skills and interests. Research industries and niches that align with your strengths. Look for trends, gaps, or opportunities that you can capitalize on. For example, if you have a talent for writing, there may be opportunities in content creation, copywriting, or blogging. If you’re skilled in graphic design, there could be freelance gigs or online courses you can create.

Additionally, consider your long-term goals and how different income streams can align with them. Are you looking to build a business, achieve financial independence, or simply supplement your current income? Understanding your objectives will help you prioritize and make informed decisions about which income streams to pursue.

Traditional Employment vs. Alternative Income Streams

Traditional employment has long been the primary source of income for many people. It offers stability, benefits, and a predictable paycheck. However, relying solely on a traditional job comes with its limitations. Exploring alternative income streams can provide additional financial security and growth opportunities.

One major limitation of traditional employment is the lack of control over your income. Your salary is typically predetermined, and raises or promotions may be infrequent. In contrast, alternative income streams, such as freelancing or side hustles, allow you to set your rates, choose your projects, and potentially earn more based on your efforts and market demand.

Additionally, traditional employment often requires a significant time commitment, which can limit your ability to pursue other income-generating activities. On the other hand, alternative income streams, such as online gigs or passive income ideas, can offer more flexibility. You can work on them during your free time, allowing you to balance a traditional job with additional revenue sources.

Furthermore, traditional employment might not always align with your passions or interests. Exploring alternative income streams can provide an opportunity to pursue what you love. Whether it’s starting a small business based on a hobby or freelancing in a field you’re passionate about, these alternatives can lead to greater job satisfaction and fulfillment.

Passive Income Ideas: Real Estate, Royalties, and More

Passive income is a powerful concept that allows you to earn money with little ongoing effort. This type of income can provide financial stability and growth, making it an attractive option for those looking to diversify their income sources. Here are some popular passive income ideas:

Real Estate

Investing in real estate is one of the most well-known passive income strategies. By purchasing rental properties, you can earn regular income from tenants. Real estate investments can appreciate over time, increasing your overall wealth. Additionally, real estate offers tax benefits and can be a hedge against inflation.

| Advantages | Considerations |

|---|---|

| Regular rental income | Initial capital required |

| Property appreciation | Property management responsibilities |

| Tax benefits | Market fluctuations |

Royalties

Royalties are another excellent source of passive income. If you have creative talents, such as writing books, composing music, or creating art, you can earn royalties from the sale or licensing of your work. This income can continue to flow in long after the initial creation.

Dividends and Investments

Investing in stocks, bonds, and other securities can generate passive income through dividends and interest. While it requires an initial investment and ongoing management, the returns can be substantial over time. Investing in dividend-paying stocks or mutual funds can provide regular cash flow, contributing to your diversified income streams.

By exploring these passive income ideas, you can create a steady flow of revenue that complements your active income sources, leading to greater financial stability and independence.

Side Hustles: Freelancing, Consulting, and Online Gigs

Side hustles have become increasingly popular as people look to supplement their income and pursue their passions. They offer flexibility and can be tailored to fit your skills and interests. Here are some common side hustles to consider:

Freelancing

Freelancing allows you to offer your skills and services to clients on a project basis. Common freelance opportunities include writing, graphic design, web development, and more. Freelancing can provide a significant income boost, and platforms like Upwork and Fiverr make it easy to find clients.

Consulting

If you have expertise in a particular field, consulting can be a lucrative side hustle. Businesses and individuals often seek consultants for specialized knowledge and advice. Whether it’s marketing, finance, or business strategy, consulting can provide a steady stream of income while allowing you to leverage your professional experience.

Online Gigs

The gig economy offers numerous opportunities for earning extra income. Platforms like Uber, TaskRabbit, and Etsy allow you to offer services or sell products online. These gigs can be flexible and cater to various interests, from driving and handyman services to crafting and selling handmade goods.

By engaging in side hustles, you can diversify your income sources and develop new skills, all while enjoying the flexibility to manage your time and workload.

Investing for Long-Term Income: Stocks, Bonds, and Mutual Funds

Investing is a crucial component of building long-term wealth and income. By putting your money into various investment vehicles, you can generate returns that contribute to your diversified income portfolio. Here are some common investment options:

Stocks

Investing in individual stocks can provide significant returns over time. By purchasing shares in publicly traded companies, you become a partial owner and can benefit from the company’s growth and profitability. Stocks can provide dividends and capital appreciation, contributing to both short-term and long-term income.

Bonds

Bonds are fixed-income securities that pay interest over a specified period. They are generally considered safer than stocks but offer lower returns. Bonds can provide a stable source of income, especially for those looking to preserve capital while earning interest.

Mutual Funds

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer professional management and diversification, making them a popular choice for those looking to invest without the need for extensive research and management.

| Investment Type | Potential Returns | Risk Level |

|---|---|---|

| Stocks | High | High |

| Bonds | Moderate | Low |

| Mutual Funds | Moderate | Moderate |

By investing in a mix of stocks, bonds, and mutual funds, you can achieve a balanced and diversified portfolio that provides long-term income and growth potential.

Building a Small Business or E-commerce Store

Starting a small business or e-commerce store is an excellent way to create an additional income stream. It allows you to turn your passions or skills into a profitable venture. Here are some steps to get started:

-

Identify a Niche: Choose a product or service that aligns with your interests and has market demand. Conduct market research to understand your target audience and competition.

-

Create a Business Plan: Outline your business goals, strategies, and financial projections. A solid business plan can guide your actions and attract potential investors or partners.

-

Set Up Your Online Presence: Build a website or use e-commerce platforms like Shopify or Amazon to sell your products. Utilize social media and digital marketing to reach a broader audience.

Running a small business or e-commerce store requires dedication and effort, but it can be incredibly rewarding. It offers the potential for significant income growth and the opportunity to work on something you’re passionate about.

Maximizing Earnings with Digital Products or Courses

Creating and selling digital products or courses is an increasingly popular way to generate income. These products can be created once and sold repeatedly, offering the potential for passive income. Here’s how to get started:

-

Identify Your Expertise: Determine the skills or knowledge you can share with others. This could be anything from coding and graphic design to cooking or fitness.

-

Create High-Quality Content: Develop engaging and valuable digital products, such as e-books, online courses, or software. Ensure your content is well-structured and professionally presented.

-

Market and Sell: Use platforms like Udemy, Teachable, or your website to sell your products. Leverage social media, email marketing, and SEO to reach your target audience.

Selling digital products or courses can provide a scalable income stream, allowing you to reach a global audience and earn money from your expertise.

Creating a Strategic Plan for Diverse Income Streams

To successfully create multiple streams of income, it’s essential to develop a strategic plan. This plan will guide your efforts, helping you stay focused and organized. Here’s how to create a strategic plan:

-

Set Clear Goals: Define your financial objectives and the income streams you want to pursue. Be specific about what you want to achieve and set realistic timelines.

-

Prioritize Opportunities: Based on your skills, interests, and market demand, prioritize the income streams that offer the best potential for success. Focus on one or two at a time to avoid spreading yourself too thin.

-

Develop Action Plans: Create detailed action plans for each income stream. Outline the steps required, resources needed, and timelines. Break down larger tasks into manageable actions.

By creating a strategic plan, you can systematically work towards building multiple income streams, ensuring that your efforts are targeted and efficient.

Maintaining and Scaling Your Income Sources Over Time

Once you have established multiple income streams, it’s essential to maintain and scale them over time. Here are some strategies to help you do this:

-

Regularly Review and Adjust: Continuously monitor the performance of your income streams. Identify what’s working and what’s not, and make adjustments as needed. Stay updated with market trends and adapt accordingly.

-

Optimize Efficiency: Look for ways to streamline your processes and increase efficiency. Use tools and automation to save time and reduce workload.

-

Expand and Diversify: As your income streams grow, consider expanding into new areas. Look for additional opportunities that complement your existing streams and diversify further to reduce risk.

By maintaining and scaling your income sources, you can ensure long-term sustainability and growth, leading to greater financial independence.

Conclusion

Creating multiple streams of income is a powerful strategy for achieving financial independence and stability. By diversifying your income sources, you can mitigate risks, enhance your earnings, and pursue your passions. This comprehensive guide has provided valuable insights and actionable strategies to help you identify your skills, explore various income streams, and develop a strategic plan.

Remember, building multiple income streams requires dedication, effort, and ongoing management. It’s essential to regularly review your progress, optimize efficiency, and adapt to market changes. By maintaining and scaling your income sources, you can create a sustainable and diversified financial ecosystem that supports your long-term goals.

Whether you’re looking to supplement your current income, achieve financial independence, or pursue new opportunities, multiple streams of income can provide the flexibility, security, and growth potential you need to succeed.

Recap

- Diversifying income sources reduces financial risk and enhances growth potential.

- Identifying your skills and interests is crucial for choosing suitable income streams.

- Traditional employment offers stability, but alternative income streams provide flexibility and growth opportunities.

- Passive income ideas, such as real estate and royalties, provide ongoing revenue with little effort.

- Side hustles, including freelancing and consulting, offer additional income and flexibility.

- Investing in stocks, bonds, and mutual funds can generate long-term income.

- Building a small business or e-commerce store allows you to turn passions into profit.

- Creating digital products or courses offers scalable income potential.

- A strategic plan is essential for successfully developing multiple income streams.

- Maintaining and scaling your income sources ensure long-term sustainability and growth.

FAQ

Q1: What are multiple streams of income?

A: Multiple streams of income refer to having various sources of revenue, rather than relying on a single income source.

Q2: Why is diversifying income important?

A: Diversifying income reduces financial risk, enhances growth potential, and provides financial flexibility.

Q3: How can I identify my skills for creating income streams?

A: Conduct a self-assessment of your professional skills, personal talents, and interests to identify potential income-generating activities.

Q4: What are some passive income ideas?

A: Passive income ideas include real estate investments, earning royalties from creative works, and investing in dividend-paying stocks.

Q5: How do side hustles differ from traditional employment?

A: Side hustles offer flexibility and the potential for higher earnings based on effort, while traditional employment provides stability and benefits.

Q6: What are common investment options for long-term income?

A: Common investment options include stocks, bonds, and mutual funds.

Q7: How can I create digital products or courses?

A: Identify your expertise, create high-quality content, and market your products through platforms like Udemy and Teachable.

Q8: What is the importance of a strategic plan for income streams?

A: A strategic plan ensures that your efforts are targeted and efficient, guiding you towards successfully building and managing multiple income streams.

References

- Kiyosaki, R. T. (1997). Rich Dad Poor Dad. Warner Books.

- Ferriss, T. (2007). The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich. Crown Publishing Group.

- Sethi, R. (2009). I Will Teach You to Be Rich. Workman Publishing Company.

Deixe um comentário